Introduction

The financial world is undergoing a profound shift. No longer is success measured solely by quarterly earnings or stock performance. Today, investors are increasingly evaluating businesses through the lens of environmental, social, and governance (ESG) criteria. This movement—often called ESG investing or sustainable finance—reflects the growing awareness that profitability and responsibility must go hand in hand.

As climate change intensifies, social justice movements gain momentum, and corporate accountability becomes non-negotiable, sustainable finance has emerged as a powerful tool to align capital with long-term global well-being. Let’s explore how ESG investing is transforming markets, the rise of green bonds and impact investing, and what the future of finance looks like when profits meet purpose.

What is ESG Investing?

- Definition

- ESG stands for Environmental, Social, and Governance.

- Investors use these three criteria to evaluate companies beyond financial metrics.

- Breakdown of ESG Factors

- Environmental: Carbon footprint, renewable energy use, waste management, water conservation.

- Social: Employee treatment, diversity and inclusion, customer protection, community engagement.

- Governance: Board diversity, executive pay, anti-corruption policies, transparency.

- Why It Matters

- Companies with strong ESG practices are more resilient to risks.

- Studies suggest ESG-focused portfolios often outperform traditional ones in the long run.

The Rise of Sustainable Finance

- Investor Demand

- Millennials and Gen Z are prioritizing ethical investments.

- In 2022, sustainable funds attracted over $500 billion globally.

- Regulatory Push

- The EU introduced the Sustainable Finance Disclosure Regulation (SFDR) to standardize ESG reporting.

- Governments worldwide are mandating ESG disclosures.

- Corporate Adaptation

- Large companies like Apple, Microsoft, and Unilever have pledged carbon neutrality goals.

- Financial institutions are integrating ESG risk assessments into lending and investment decisions.

Tools of Sustainable Finance

- Green Bonds

- Bonds issued to finance environmentally friendly projects (renewable energy, clean transport).

- By 2023, the global green bond market surpassed $2 trillion.

- Impact Investing

- Investments made with the intention of generating measurable social or environmental impact alongside returns.

- Example: Funds that support affordable housing or clean water initiatives.

- Sustainable Index Funds & ETFs

- Allow retail investors to back ESG-friendly companies.

- Examples: MSCI ESG Leaders Index, iShares ESG Aware ETFs.

Benefits of ESG Investing

- Risk Management

- Companies with poor ESG practices face reputational and financial risks.

- Example: Oil spills (BP), data privacy breaches (Facebook).

- Long-Term Value

- Sustainable companies often have stronger customer loyalty and lower regulatory risks.

- Attracting Capital

- ESG-focused businesses attract more institutional investors.

- Sustainable finance is not a niche trend—it’s mainstream.

Challenges in ESG Investing

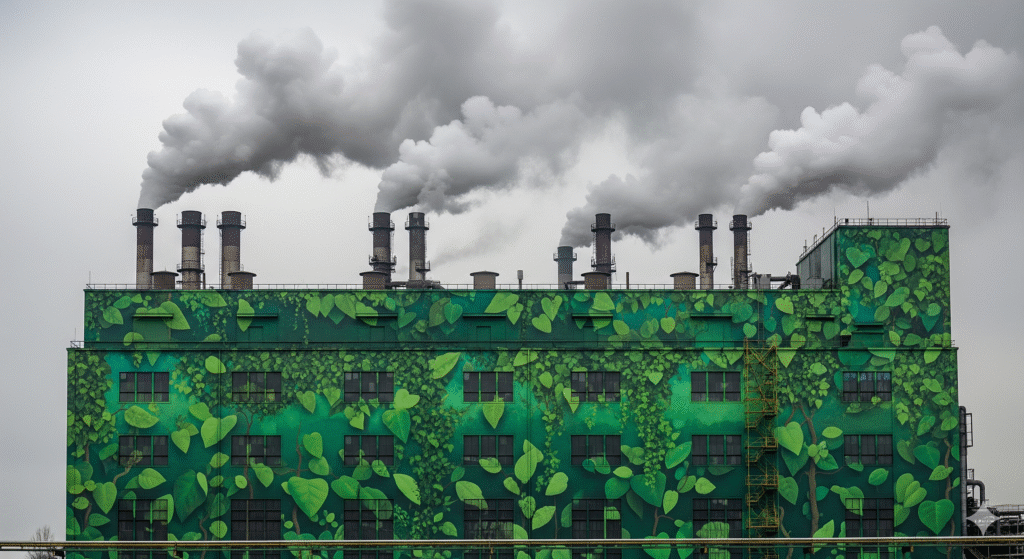

- Greenwashing

- Companies may exaggerate or falsify ESG claims.

- Example: Some firms label bonds “green” without significant environmental benefits.

- Lack of Standardization

- Different ESG rating agencies often score the same company differently.

- Investors struggle to compare data.

- Short-Term Costs

- Transitioning to ESG compliance requires significant upfront investment.

- Not all companies can immediately absorb these costs.

Case Studies

- Tesla

- Seen as an ESG leader for advancing electric vehicles.

- Yet criticized for labor practices and governance issues.

- Unilever

- Longstanding commitment to sustainability through the “Unilever Sustainable Living Plan.”

- Example: Brands like Dove and Ben & Jerry’s emphasize environmental and social causes.

- BlackRock

- The world’s largest asset manager committed to putting sustainability at the core of its strategy.

- CEO Larry Fink’s annual letters highlight ESG as essential to long-term financial performance.

The Future of ESG and Sustainable Finance

- Mandatory ESG Reporting

- More governments will enforce standardized disclosures.

- This will reduce greenwashing and improve transparency.

- Integration with Digital Finance

- Blockchain could provide tamper-proof ESG data.

- Tokenized green bonds may open sustainable investments to more people.

- Growing Role of Retail Investors

- Apps like Robinhood and Wealthsimple now offer ESG portfolios.

- Young investors are demanding ethical choices.

- Global Collaboration

- Sustainable finance is crucial for meeting UN Sustainable Development Goals (SDGs).

- Expect stronger cooperation between governments, corporations, and NGOs.

Conclusion

ESG investing and sustainable finance represent more than a trend—they are a necessary evolution in how capital markets operate. By aligning financial success with environmental and social responsibility, investors are ensuring a future where profits contribute to the well-being of the planet and its people.

The movement toward green bonds, impact investing, and ESG-focused portfolios is proof that money can be both a driver of wealth and a force for good. As regulations tighten and investor demand grows, companies that ignore sustainability will risk being left behind.

In the future, finance won’t just be about returns—it will be about responsibility. And that’s a future worth investing in.