Introduction

In today’s interconnected and rapidly changing world, risk management has become a cornerstone of modern finance. From the 2008 global financial crisis to the COVID-19 pandemic, and now ongoing market volatility, financial institutions, investors, and businesses have learned that risks are not only unavoidable—they are often unpredictable.

Risk management in finance isn’t just about avoiding losses. It’s about strategic planning, innovation, and resilience. With tools like data analytics, fintech solutions, and artificial intelligence, organizations are finding smarter ways to identify, measure, and mitigate risks, turning challenges into opportunities.

Understanding Financial Risks

Financial risks can be categorized into several key types:

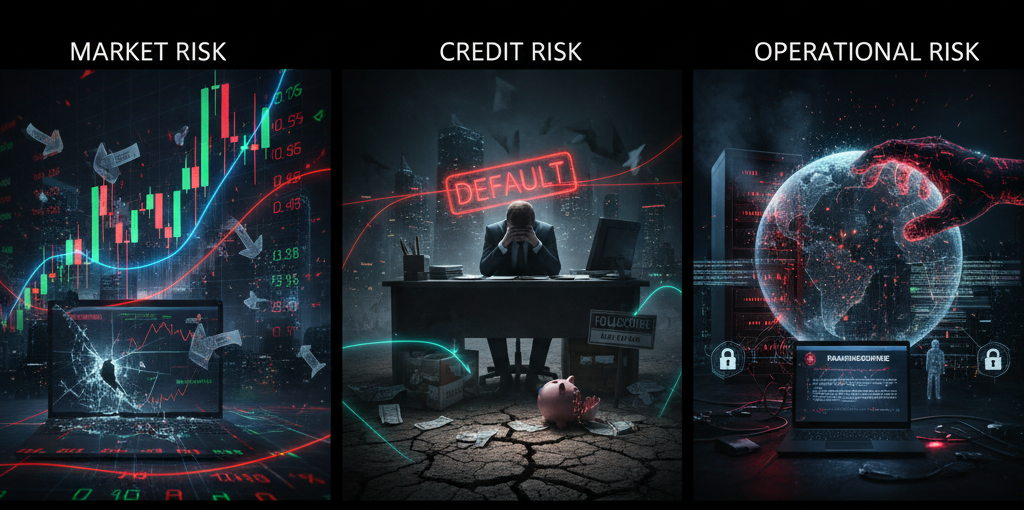

- Market Risk

- Arises from fluctuations in stock prices, interest rates, exchange rates, and commodities.

- Example: Sharp oil price drops affecting energy companies.

- Credit Risk

- The possibility of a borrower defaulting on debt.

- Example: Loan defaults during recessions.

- Operational Risk

- Risks from internal failures, such as system outages or fraud.

- Example: Cyberattacks on banks causing financial and reputational damage.

- Liquidity Risk

- When businesses or banks cannot meet short-term obligations due to lack of cash.

- Regulatory and Compliance Risk

- Stricter financial regulations, especially in digital banking, cryptocurrency, and DeFi, can affect business operations.

Lessons from Past Crises

- 2008 Global Financial Crisis: Poor risk assessment in mortgage-backed securities led to worldwide collapse.

- COVID-19 Pandemic: Exposed vulnerabilities in supply chains, market stability, and global trade.

- Market Volatility in 2022–2023: Rising inflation and geopolitical tensions tested investor confidence.

These crises taught the importance of scenario planning, stress testing, and diversification in financial systems.

These crises taught the importance of scenario planning, stress testing, and diversification in financial systems.

Modern Tools for Risk Management

- Data Analytics & AI

- Predictive models assess creditworthiness and detect fraud in real-time.

- AI-driven algorithms forecast market volatility for better decision-making.

- Fintech & Digital Banking

- Apps now offer risk alerts, investment monitoring, and automatic diversification.

- Digital platforms provide micro-risk insurance for small investors.

- Blockchain and DeFi

- Transparent, immutable records reduce fraud and operational risks.

- Smart contracts automate risk management in decentralized finance.

- Cloud Computing

- Enhances cybersecurity and disaster recovery systems.

- ESG and Sustainable Finance

- Integrating environmental and social factors reduces long-term risks, especially for climate-sensitive investments.

Role of Wealth Management in Risk Mitigation

Wealth management strategies are increasingly centered on risk-adjusted returns.

- Diversification: Spreading investments across asset classes, including cryptocurrency, green bonds, and impact investments.

- Hedging Strategies: Using derivatives to manage exposure.

- Long-Term Planning: Adjusting portfolios to withstand market disruptions.

Case Studies

Case Study 1: JPMorgan Chase’s AI-Powered Risk Monitoring

- Uses machine learning to track credit risks and fraud detection.

- Saves billions by reducing loan defaults and fraudulent transactions.

Case Study 2: COVID-19 Supply Chain Finance

- Companies that implemented supply chain risk management through digital platforms navigated disruptions better.

Case Study 3: BlackRock’s Sustainable Portfolios

- By embedding ESG into investments, BlackRock reduced long-term climate-related risks while appealing to socially conscious investors.

Risk Management in Emerging Areas

- Cryptocurrency & DeFi

- Highly volatile but increasingly mainstream.

- Investors mitigate risks via stablecoins and regulated exchanges.

- Central Bank Digital Currency (CBDC)

- Introduces new risks (cybersecurity, privacy) but can enhance financial stability if well-governed.

- Global Governance and Regulation

- International frameworks are evolving to manage cross-border risks in finance and trade.

Challenges in Risk Management

- Unpredictability of Global Events – Black swan events like pandemics and geopolitical conflicts.

- Cybersecurity Threats – Rising attacks on digital banking and fintech platforms.

- Greenwashing Risks – In sustainable finance, false ESG claims can mislead investors.

- Over-Reliance on Technology – AI systems themselves carry risks of bias and system failure.

Future of Risk Management in Finance

- AI + Human Collaboration

- Hybrid systems that combine AI predictions with human judgment.

- Integrated Global Standards

- Stronger international law and global governance on financial risks.

- Decentralized Risk Solutions

- Growth of blockchain and Web3 for transparent, community-driven risk frameworks.

- Focus on Mental Health and Human Capital

- Financial organizations recognizing mental health as a key risk in employee productivity and decision-making.

- Real-Time Risk Dashboards

- Investors and corporations will monitor risks like weather events, supply chain issues, and political unrest instantly.

Conclusion

In finance, risk will always exist—but how we manage it defines whether it becomes a setback or an opportunity. From market volatility to cryptocurrency uncertainty, and from supply chain disruptions to climate-related challenges, effective risk management ensures resilience.

The integration of fintech, AI, sustainable finance, and global cooperation is creating a more robust system. For businesses and investors, mastering risk management is not just about survival—it’s about thriving in uncertain times and building confidence for the future.

These crises taught the importance of scenario planning, stress testing, and diversification in financial systems.

These crises taught the importance of scenario planning, stress testing, and diversification in financial systems.