Introduction

The financial industry is in the middle of a historic transformation. From digital wallets to robo-advisors, technology has rewritten how money is managed, invested, and transferred. This revolution—driven by fintech (financial technology) and digital banking—is not just about convenience; it’s about building a system that is faster, more inclusive, and more resilient.

As cryptocurrency, DeFi, and Central Bank Digital Currencies (CBDCs) reshape traditional banking, we are witnessing the early stages of a cashless future. But what exactly is fueling this fintech wave, and how will it impact consumers, businesses, and the global financial system?

What is Fintech?

- Definition

- Fintech refers to the use of innovative technologies to improve financial services.

- Examples: Mobile banking apps, peer-to-peer lending platforms, payment gateways like PayPal, and robo-advisory tools.

- Why Fintech Matters

- Reduces costs for consumers and businesses.

- Increases access to financial services for the unbanked population.

- Enhances speed, personalization, and security in transactions.

The Digital Banking Revolution

- From Traditional Banks to Neobanks

- Traditional banks: Slow-moving, heavy on paperwork, high fees.

- Neobanks (digital-only banks): Mobile-first, low-cost, user-friendly, often with AI-driven financial advice.

- Examples: Chime, Revolut, Monzo, N26.

- Core Features of Digital Banks

- 24/7 access via mobile apps.

- Real-time payments and low-cost international transfers.

- Integrated budgeting and financial wellness tools.

- Consumer Shift

- Surveys show younger generations trust fintech firms more than traditional banks.

- Digital banking adoption surged during COVID-19, as lockdowns forced people online.

Key Innovations in Fintech

- Mobile Payments & Wallets

- Examples: Apple Pay, Google Pay, Paytm, Alipay.

- Mobile wallets are increasingly replacing physical cards.

- Robo-Advisors

- Automated platforms like Betterment and Wealthfront provide investment guidance at low fees.

- Buy Now, Pay Later (BNPL)

- Firms like Klarna, Afterpay, and Affirm disrupted credit cards with flexible payment plans.

- Blockchain and DeFi

- Enables secure, transparent, and decentralized financial transactions.

- Smart contracts remove the need for intermediaries.

- Artificial Intelligence & Machine Learning

- Used for fraud detection, credit scoring, and personalized banking services.

Benefits of Fintech and Digital Banking

- Financial Inclusion

- Over 1.4 billion adults remain unbanked (World Bank, 2022).

- Fintech provides access to banking through smartphones.

- Lower Costs

- Neobanks and fintech firms operate without expensive physical branches.

- Savings are passed on to customers in the form of lower fees.

- Enhanced Customer Experience

- Personalized insights, faster transactions, 24/7 availability.

- Global Reach

- Cross-border transactions are simpler and cheaper.

- Important for international freelancers, small businesses, and global trade.

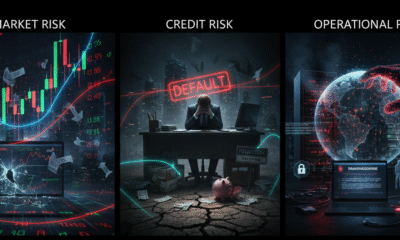

Challenges in the Fintech Revolution

- Cybersecurity Risks

- With more digital transactions, cyberattacks and data breaches are on the rise.

- Regulatory Uncertainty

- Many governments are still figuring out how to regulate fintech firms and cryptocurrencies.

- Lack of uniform laws creates risks for global companies.

- Market Volatility

- Digital currencies and fintech startups are vulnerable to sudden changes in regulation and investor sentiment.

- Trust Issues

- Some consumers worry about relying on digital-only banks with no physical branches.

Case Studies

- Revolut (UK)

- Started as a currency exchange app, now offers banking, investing, and crypto trading.

- Over 35 million users worldwide.

- Paytm (India)

- Transformed India’s payment landscape with mobile wallets and QR-based payments.

- Played a major role in India’s shift toward a cashless economy after demonetization.

- Stripe (USA)

- Revolutionized online payments for businesses.

- Used by companies from startups to giants like Amazon.

The Future of Fintech and Digital Banking

- Central Bank Digital Currencies (CBDCs)

- Governments are testing digital currencies (China’s Digital Yuan, EU’s Digital Euro, India’s Digital Rupee).

- Could make cross-border trade faster and reduce reliance on cash.

- Open Banking

- Sharing of financial data (with customer consent) between banks and third parties.

- Will lead to more personalized and competitive financial services.

- Embedded Finance

- Non-financial platforms (like Uber or Amazon) integrating financial services directly.

- Example: Loans and payments embedded within e-commerce apps.

- AI-Powered Financial Advisors

- Virtual assistants will provide real-time, personalized money management.

- Towards a Cashless Future

- Scandinavian countries already use digital payments for 90%+ of transactions.

- By 2030, physical cash could become a niche form of payment.

Conclusion

The rise of fintech and digital banking marks one of the most significant changes in modern financial history. From neobanks to blockchain-based platforms, innovation is driving a system that is more inclusive, transparent, and efficient.

Yet, the road ahead is not without challenges. Cybersecurity, regulation, and volatility will determine how smoothly we transition into a cashless future. For consumers and businesses alike, embracing fintech isn’t optional—it’s the new normal.

In the coming years, the winners will be those who adapt to digital-first finance while balancing innovation with trust and security. The cashless revolution has already begun, and its impact will be felt across every corner of the global economy.